Empowering your business with strategic financial insight and clarity—without the full-time commitment.

Get in touch

At Finwise Insight, our fractional CFO services go beyond numbers to deliver the financial clarity, strategic insight, and operational support your business needs to thrive. We partner with you to create forward-looking strategies, streamline financial processes, and provide the decision-making insights that make a real impact. Whether you’re scaling your operations, navigating complex financial landscapes, or seeking to boost profitability, our flexible, expert-led approach brings CFO-level guidance without the full-time overhead—empowering your business to reach new heights.

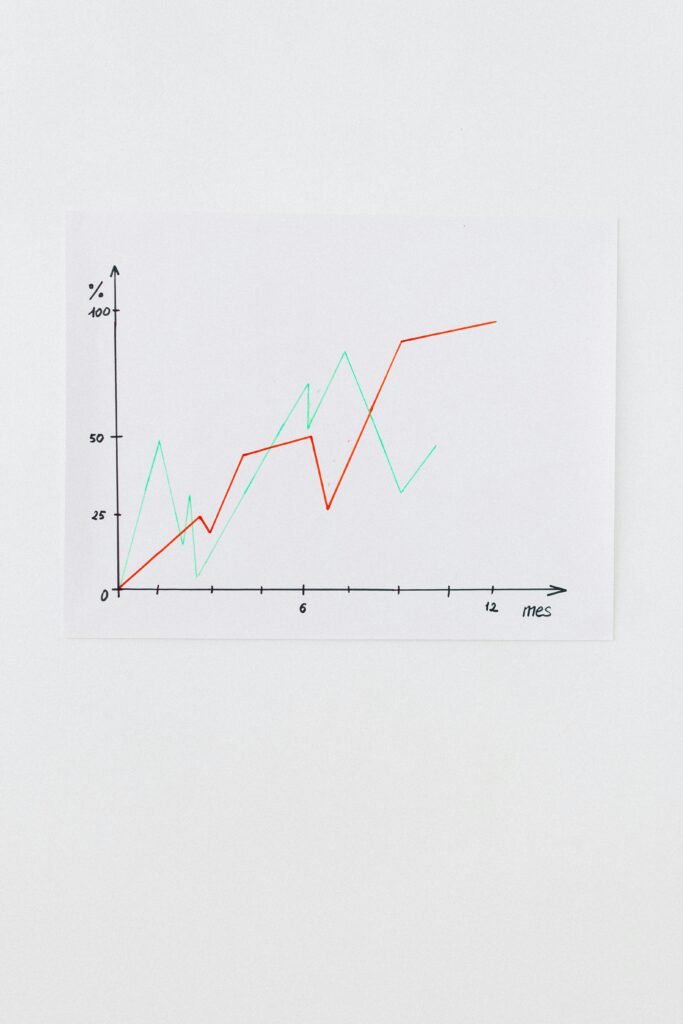

As a fractional CFO, I bring top-tier financial strategy and guidance tailored to your business without the overhead of a full-time executive. I collaborate with you to develop comprehensive financial plans, from forecasting and budgeting to strategic financial analysis, all aimed at enhancing profitability and operational efficiency. My goal is to help you understand and navigate your financial landscape, enabling you to make well-informed decisions with clarity and confidence.

With my services, you gain access to detailed cash flow management, cost analysis, and profit optimization tools, ensuring a stronger financial foundation for growth. I provide in-depth reporting, risk assessment, and KPI development, giving you a clear view of your business’s performance and potential. Whether you’re looking to scale, streamline, or overcome financial challenges, I’m here to provide the expertise and strategic insight you need to drive sustainable success.

Developing long-term financial plans to support sustainable business growth.

Optimizing cash flow to ensure smooth daily operations and growth.

Creating precise budgets and forecasts to guide financial decisions.

Identifying financial risks to safeguard your business’s future stability.

Improving profitability by analyzing costs and maximizing revenue opportunities.

Evaluating financial performance to identify strengths and improvement areas.

With over 25 years of proven expertise in financial planning, analysis, and strategic accounting, I offer a comprehensive, high-impact approach to managing your business’s financial health and driving sustainable growth. My experience across diverse industries—from manufacturing and retail distribution to long-term services and property management—gives me a unique perspective and an adaptive edge. By hiring me as your fractional CFO, you gain top-tier financial guidance and operational support tailored to your specific goals, without the full-time commitment. My focus is on equipping your business with the strategic insights and efficient processes needed to reach your highest potential.

I bring over 23 years of hands-on experience in financial planning, analysis, and strategic accounting across a variety of industries. My approach is to create a custom financial roadmap for each client, aligned with their specific growth and stability goals. I collaborate with business leaders to establish a clear vision and implement financial strategies that will foster long-term success. By working closely with your team, I ensure that our financial strategies support both immediate needs and future expansion, empowering you to navigate the challenges and opportunities ahead confidently.

Effective cash flow management is crucial to maintaining smooth operations and making well-timed investments. With my extensive background in cash flow analysis and treasury management, I implement strategies that help your business maximize liquidity and minimize shortfalls. This includes forecasting cash needs, identifying areas to improve cash inflows and outflows, and managing working capital effectively. I work to provide you with the flexibility to reinvest in growth opportunities while ensuring you’re prepared for any cash demands that may arise. My goal is to give your business the financial resilience it needs to thrive day-to-day and in the long run.

I specialize in creating precise budgets and forecasting models that guide decision-making and help your business stay on track with financial goals. Using historical data, industry trends, and future projections, I develop comprehensive models that provide clear financial visibility. This planning enables proactive decision-making, helping you anticipate financial needs, allocate resources efficiently, and maintain alignment with your strategic objectives. By providing accurate and timely forecasts, I help ensure your company can adapt and respond to market changes and growth opportunities effectively.

Through thorough cost analysis and profit optimization strategies, I help your business uncover opportunities for savings and revenue growth. I examine all cost components, from labor and materials to overhead and operational expenses, identifying areas where efficiency improvements or cost reductions can be achieved. My approach goes beyond cutting costs; I look at ways to enhance profitability, whether through product mix optimization, price adjustments, or process improvements. With insights from these analyses, I provide actionable recommendations that help drive a healthier bottom line.

ERP systems and automated processes are vital for accurate, efficient financial reporting and management. I bring years of experience in ERP implementation, upgrades, and process automation to improve data accuracy and streamline workflows. By assessing your current system needs, I can either optimize your existing ERP system or oversee a new implementation that supports your operational goals. This often includes reducing manual entries, establishing real-time reporting, and setting up automated processes to ensure that your team has access to timely and reliable financial data.

I deliver clear, detailed financial reporting, including monthly and quarterly statements, KPIs, and performance metrics tailored to your business. My reporting services provide a comprehensive view of your financial health, highlighting key performance indicators and identifying areas of concern or opportunity. I ensure that these reports are not only accurate but also easy to understand, empowering you to make informed decisions. With regular performance analysis, you gain the insights needed to drive your business forward strategically and sustainably.

Hiring me as a fractional CFO gives you the benefit of high-level financial expertise without the full-time cost. My services are adaptable to your business’s unique needs and can scale up or down based on your requirements, whether you’re experiencing rapid growth, seasonal demand, or specific project needs. This flexible model provides you with CFO-level support when you need it most, ensuring that you have the guidance and insight to make key financial decisions while keeping overhead low. It’s an ideal solution for businesses looking to access strategic financial leadership without the commitment of a permanent hire.